who pays sales tax when selling a car privately in illinois

By law a dealer has 20 days to send your title transfer and sales tax to the secretary of state s office. However you do not pay that tax to the car dealer or individual selling the car.

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

In addition to state and county tax the City of Chicago has a 125 sales tax.

. For vehicles worth less than 15000 the tax is based on the age of the vehicle. You should also keep in mind that youll have to pay the dealership a fee if they take part in putting together your documents. Selling a car in Illinois does not require much paperwork.

It starts at 390 for a one-year old vehicle. Exemptions If one of the following exemptions applies. Who Pays Sales Tax When Selling a Car Privately in Illinois 19 april 2022 MogulSkier2016 As a result of this decision the Ministry of Finance adopted the position that all incentives to factories are subject to VAT.

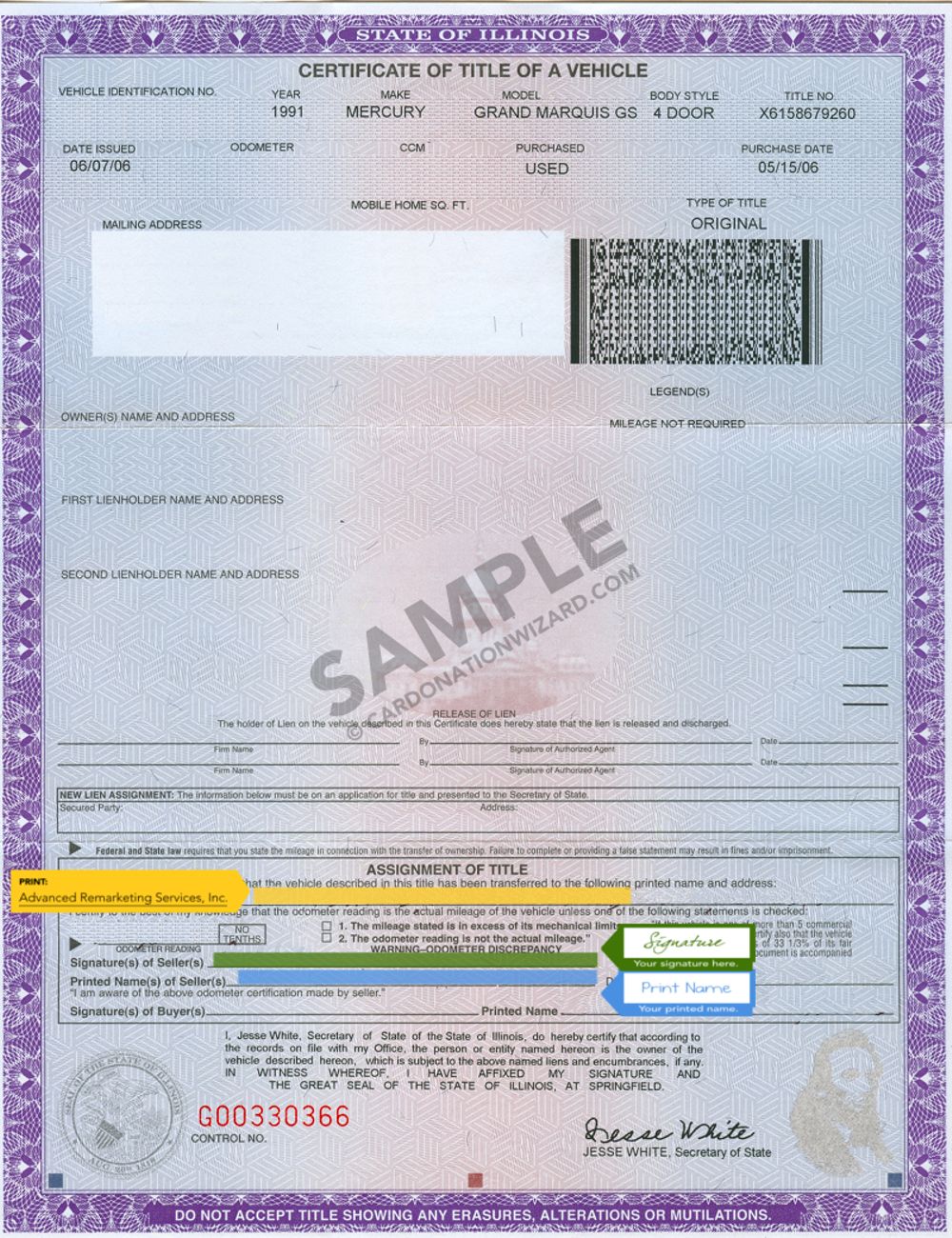

See our Title Transfers in Illinois page for complete details. Get your car ready for selling. You can also pick up a form at the Illinois SOS office or request one to be sent to you by calling 800 252-8980.

You typically have to pay taxes on a car received as a gift in illinois. This tax is paid directly to illinois department of. The dealer pays both the vehicle tax due and the title and registration fees when he submits form rut 25 to the illinois secretary of state s office which forwards the tax portion to the department of revenue.

Transferring License Plates after a Sale. There also may be a documentary fee of 166 dollars at some dealerships. Depending on where you live the tax could be 7-10 so thats a lot of money.

The taxes can be different in the case of a vehicle being purchased by a private party. You can process the transaction at your local Secretary of State office or by mailing the paperwork to the Secretary of States main office. Illinois law forbids the sale or.

It ends with 25 for vehicles at least 11 years old. You will pay it to your states DMV when you register the vehicle. If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax on the 15000 or less val-uation.

When you sell your car you must declare the actual selling purchase price. Unlike in other states the required documents needed are only title and registration which makes car sales less difficult. Buyers must pay a transfer tax when they buy a car from a private seller in illinois although this tax is lower when you buy from a private party than when.

The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle. This tax is paid directly to the Illinois Department of Revenue. However there WILL be an audit by the Illinois Department of Revenue that shows the fair market value is 60000.

Who Pays Sales Tax When Selling A Car Privately In Illinois. Youll need to have the title sales tax form and other paperwork which varies according to the situation. If the selling price is 15000 or more the tax is based on the selling price of the vehicle.

The buyer must pay 95 to the secretary of state and a tax to the department of revenue. Selling A Used Car In Illinois Tax. The taxes can be different in the case of a vehicle being purchased by a private.

When its your personal car you can do as you please and keep your. When you purchase a vehicle through a private sale you must pay the associated local and state taxes. The first thing you need to do is get your car ready for selling.

I bought a hybrid car recently. Remove the vehicle s license plates. Buyers must pay a transfer tax when they buy a car from a private seller in Illinois although this tax is lower when you buy from a private party than when you buy from a Dealer.

Use the illinois tax rate finder to find your tax. The state of Illinois charges a 725 sales tax rate on all vehicle purchases. See RUT-6 Form RUT-50 Reference Guide to determine whether you must report any local government private party vehicle use tax on Form RUT-50.

To transfer your license plates after you sell your car in Illinois you will need to submit an Application for Vehicle Transaction s Form VSD 190 to the IL SOS in person. The trade off to eliminate the tax cap was to slightly increase the tax on private car sales. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

When you sell a personal vehicle for less than you paid for it theres no need to pay tax. This shows how popular car sales are in the United States of which Illinois is not an exception. Use the illinois tax rate finder to find your tax.

A car can be sold in Illinois through a dealership or privately. There is also between a 025 and 075 when it comes to county tax. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. Heres how to sell a car in Illinois and get started. Illinois law requires the recipient or buyer of any car transferred in the state to complete a Private Party Vehicle Tax Transaction form form RUT-50 and pay sales tax for the car within 30 days of the transfer.

The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. County taxes range from 025 to 075 while in the city of Chicago youre required to pay a 125 city tax.

The used car market is still pretty hot and you can take advantage of this time to get even more for your vehicle. Illinois Private Party Vehicle Use Tax Step 6 Line 1 Other transaction types that may be reported on Form RUT-50 are listed below along with the required tax amount due.

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

Steps To Take When Selling A Car In Illinois Cash Cars Buyer

How To Buy A Car Out Of State Nextadvisor With Time

Illinois Used Car Taxes And Fees

What Is The Sales Tax On A Car In Illinois Pasquesi Sheppard Llc

Steps To Take When Selling A Car In Illinois Cash Cars Buyer

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Which U S States Charge Property Taxes For Cars Mansion Global

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

What Is Illinois Car Sales Tax

How Do I Sell My Car Illinois Legal Aid Online

How To Gift A Car A Step By Step Guide To Making This Big Purchase

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Steps To Take When Selling A Car In Illinois Cash Cars Buyer

Illinois Car Trade In Tax Changes Starting January 2020 Honda City Chicago

Fees Taxes And The Five Finger Flip What To Watch Out For When Buying A New Car

Steps To Take When Selling A Car In Illinois Cash Cars Buyer